TABLE OF CONTENT

- What Is a Personal Injury Protection Claim?

- How to Claim Personal Injury Protection?

- Case Study: Cameron v Liverpool Victoria Insurance Co Ltd

- Conclusion

- FAQs

Your Personal Injury Protection claim asks for money to cover costs associated with your injuries after an accident. The amount you get depends on the type of claim and who pays for it. It enables people who get hurt to get medical care, help with their recuperation, and time off work, no matter where the accident happened, including on the road, at work, in a public place, or somewhere else. The steps are usually the same: get medical help, report the incident, collect evidence, file the claim, and keep checking in until a decision or settlement is reached.

What Is a Personal Injury Protection Claim?

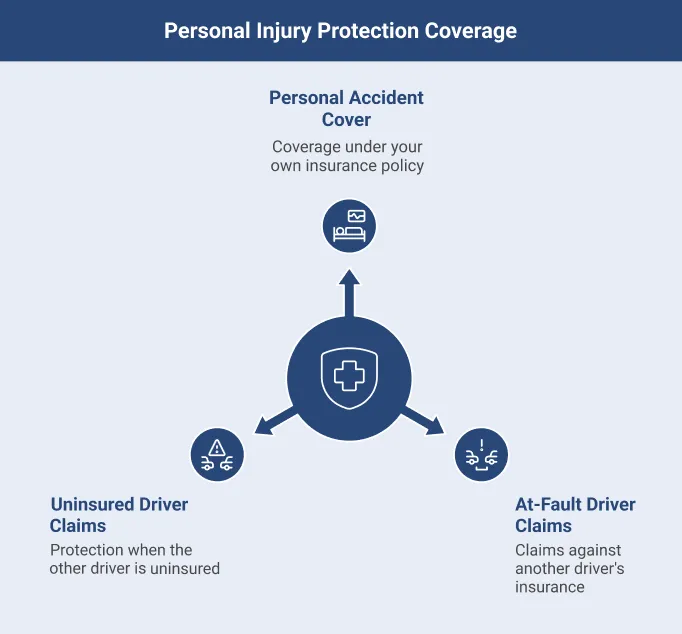

When you file a personal injury protection claim, you ask your insurance company or the right claim process to pay for things like medical care and time off work following an accident.

People in the UK often refer to PIP as “no-fault” coverage. If you have no-fault insurance, your own insurance company can cover the injuries of you and your passengers, no matter who caused the collision. A lot of places that don’t have culpability nonetheless let people sue, but only for serious harm.

The amount of personal injury protection benefits depends on where you reside and what kind of coverage you have. But the premise is still the same. It wants to get paid swiftly for things like medical care and lost wages.

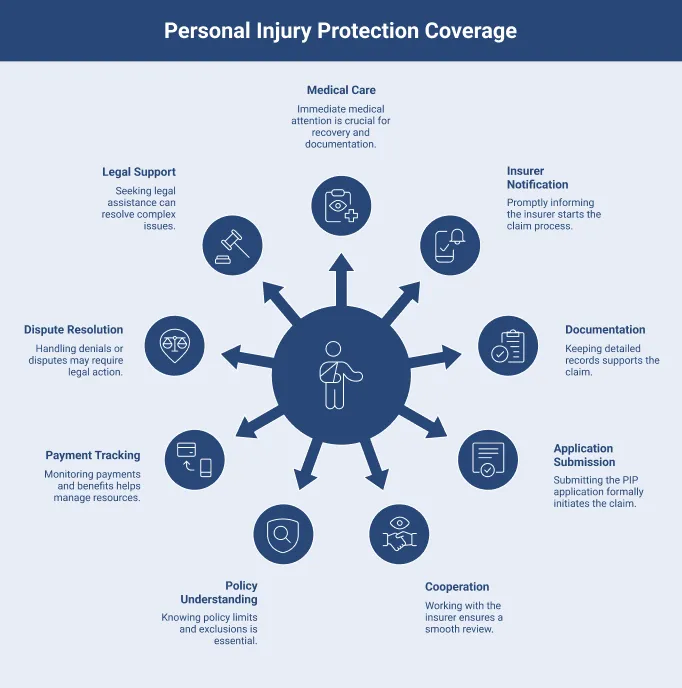

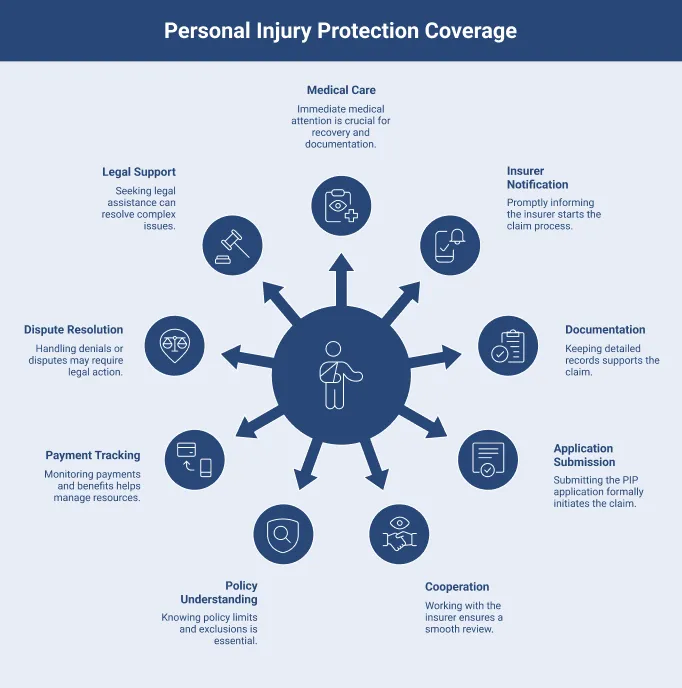

How to Claim Personal Injury Protection?

People tend to make mistakes when they hurry, guess, or think the insurer ‘already knows.’

1. Get Medical Care Immediately

The most important thing is your health. Real danger? Call 999. Get help for concerning but non-life-threatening symptoms through the relevant NHS channel. Keep in mind that certain injuries take time to appear. Pain may appear later after a crash. The NHS advises seeking immediate medical attention for whiplash symptoms include extreme pain, tingling, weakness, or difficulty walking.

Here’s what to do:

- Check if the pain gets worse.

- Do what your doctor says.

- Write down your symptoms every day.

- Keep copies of any medical papers you get when you leave.

Here’s why this matters for a personal injury protection claim:

- It keeps you safe.

- It makes a record of your health.

2. Notify Your Insurer Promptly

The UK government’s official site outlines it very clearly. Even if you don’t plan to file a personal injury protection claim, you still need to tell your insurance company about the accident.

You also need to give information (name, address, registration number) if the accident caused damage or injury. The official website of the Government of UK says that if you didn’t give your information at the time of the accident, you need to tell the police within 24 hours.

Here’s practical script for the call:

- State the date, time, and location.

- Say if anyone was injured.

- Give information about the relevant/involved party (if you know it).

- Request a number for your claim.

- Find out what papers they want and where to send them.

- Don’t guess who is at fault on the call. Just state the facts.

3. Document Everything

Good documentation is not ‘extra.’ It is the main part of your personal injury protection claim.

Make a simple folder, either on paper or online, and keep:

i. Accident Facts

- Date and time.

- Exact location.

- Weather and road conditions.

- Where you were going.

- Speed (if you know it, don’t guess).

- What happened in what order.

ii. People and Vehicles Details

- The name, address, and registration of the other driver.

- Make and model of the car.

- Information about the insurer (if you have it).

- Names and contact information for witnesses.

iii. Photos and Evidence

- Close-up and wide shots of damage to the vehicle.

- Signs and markings on the road.

- Injuries (bruises can change quickly).

- Save a copy of the dashcam footage.

iv. Costs and Losses

- Pay stubs and notes from the doctor (if you missed work).

- Travel receipts for appointments.

- Receipts for prescriptions and treatments.

- Care notes (who helped you, and how).

Want to learn about the Personal Injury Claim Time Limit UK? When you file your claim, it’s important to know the deadlines.

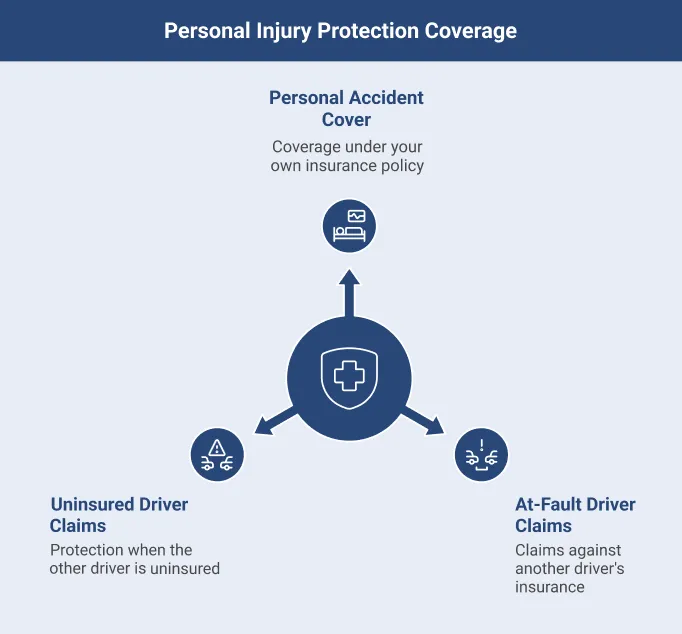

4. Submit the PIP Application

The meaning of ‘the application’ changes depending on the type of claim you’re making.

Case A: Claim on Your Own Policy (Personal Accident / Personal Injury Cover)

Get the personal accident claim form or process from your insurance company. Then:

- Make sure you know who is covered (you, named drivers, and passengers).

- Check to see what kinds of injuries qualify.

- Make sure you know the deadlines for sending in documents and letting people know.

- Find out if they need a medical report or certain words.

Case B: Use Official Injury Claim (England and Wales)

Official Injury Claim (OIC) tells you who can use the service. It is for a lot of small injuries where:

- You are over 18.

- The accident happened in Wales or England.

- It happened on or after May 31, 2021.

- You were in a car.

- You think it wasn’t your fault.

- The injury value is less than £5,000.

OIC’s process starts with:

- The claim by giving details about the accident and injuries.

- Investigation by the insurer.

- Appointment and report for medical care.

- Offer and talk.

- Payment and closing.

Case C: Claim Through MIB (Uninsured Or Hit And Run)

If you don’t have insurance or were in a hit-and-run accident, The official website of the Government of UK tells you to go to the MIB. You can also file personal injury protection claims online, but you will need to sign up first, according to the MIB.

5. Cooperate With the Insurer’s Review

After you send in your personal injury protection claim, the insurers (or ‘compensator’ in OIC terms) will look it over. OIC says that after you submit your personal injury protection claim, it goes to the insurance company for the driver you say is at fault, and they look into it.

Here’s what cooperation usually looks like:

- Answering questions that come up later.

- Sending more papers.

- Going to a medical exam (if necessary).

- Confirming payment information for the bank.

Here’s what to avoid:

- Sending edited photos without keeping the originals.

- Making your story ‘sound better.’

- Not telling them when you miss a deadline.

- If you need more time, write it down.

6. Know Your Policy Limits and Exclusions

This is where a lot of personal injury protection claims go wrong. Personal accident cover is often limited by:

- Maximum payout amounts.

- Clear definitions of ‘permanent’ or ‘loss.’

- Exclusions for illegal acts, alcohol/drugs, or not wearing a seatbelt.

There are still limits on who can use the OIC route and how much it costs, such as the £5,000 injury value threshold for that service.

So always check:

- Who is insured?

- What injuries count?

- What proof is needed?

- What are the time limits?

7. Track Payments and Remaining Benefits

Use a simple tracker (notes app is fine). Or, if you use OIC, it says you can check the status of your personal injury protection claim online and get updates when they happen.

If you get money from a personal accident policy, make sure:

- If it’s one payment or a series of payments.

- If it has an effect on any other policy benefits.

- If more medical evidence is needed later.

You can read our article on What is Personal Injury Compensation Claim to learn more about what counts as a personal injury.

8. Handle Denials or Disputes

There are many reasons why someone might say no, such as:

- The injury doesn’t fit the definition in the policy.

- Evidence that is missing.

- Reporting late.

- There is an exclusion.

- There is disagreement about fault (for claims for compensation).

Your first step is easy:

- Get the decision in writing.

- Ask them what rule or clause they used.

- Ask what proof would change the choice.

If you are in OIC and there is a disagreement about who is at fault, the wider guidance says that disputes can go to court if the personal injury protection claim can’t be settled in the service. The service also helps with some parts of getting ready for court.

If you have a problem with how an insurance company is handling your claim, you can file a complaint and then, if necessary, go to the Financial Ombudsman Service (FOS). FOS says it can look into complaints about insurance and decide if the business did you wrong. If so, it might tell them to fix things.

9. Seek Legal Support If Needed

You might not need a lawyer for every personal injury protection claim. But legal help can be helpful if:

- The injury is bad.

- There is a lot of disagreement about who is to blame.

- Your losses are complicated (future care, being away from work for a long time).

- You are given a settlement that doesn’t feel right.

- There is a lot of pressure to settle quickly.

Citizens Advice also says that you should get legal advice right away if you want to take legal action because there are strict time limits. It also says that you can pursue personal injury protection claims for free (for minor road injuries that happened after May 31, 2021).

Deadlines are important. In many cases, the limit for personal injury claims based on negligence is three years. Citizens Advice says that you must file a lawsuit within three years of when you first realised you were hurt.

Case Study: Cameron v Liverpool Victoria Insurance Co Ltd

(UK Supreme Court, 2019)

In May 2013, Miss Cameron was driving when she collided with a Nissan Micra. The Micra driver did not stop. A passing driver noted the number plate. The Micra was insured with Liverpool Victoria (LV). Miss Cameron tried to claim by suing the registered keeper, but it later became clear the keeper and the LV policyholder were not the driver at the time.

Because the actual driver could not be identified, the case became about process. Could she sue an “unknown driver” just to reach the insurer? The UK Supreme Court said this type of “person unknown” defendant is not allowed when the driver cannot be identified at all (as in most hit-and-run cases). The Court explained there is a difference between an unnamed defendant who is still identifiable (like “the squatters in X building”) and a driver who cannot be identified.

Conclusion

It’s best to act quickly and stay organised when you make a personal injury protection claim. Get medical help right away. Tell your insurance company right away. Keep all of your records. Fill out forms the right way. Keep track of payments. Use facts to fight denials. Most importantly, follow your policy. PIP rules can be very strict and different from one state to the next. Get legal advice early when the stakes are high.

FAQs

Your Personal Injury Protection claim asks for money to cover costs associated with your injuries after an accident. The amount you get depends on the type of claim and who pays for it. It enables people who get hurt to get medical care, help with their recuperation, and time off work, no matter where the accident happened, including on the road, at work, in a public place, or somewhere else. The steps are usually the same: get medical help, report the incident, collect evidence, file the claim, and keep checking in until a decision or settlement is reached.

What Is a Personal Injury Protection Claim?

When you file a personal injury protection claim, you ask your insurance company or the right claim process to pay for things like medical care and time off work following an accident.

People in the UK often refer to PIP as “no-fault” coverage. If you have no-fault insurance, your own insurance company can cover the injuries of you and your passengers, no matter who caused the collision. A lot of places that don’t have culpability nonetheless let people sue, but only for serious harm.

The amount of personal injury protection benefits depends on where you reside and what kind of coverage you have. But the premise is still the same. It wants to get paid swiftly for things like medical care and lost wages.

How to Claim Personal Injury Protection?

People tend to make mistakes when they hurry, guess, or think the insurer ‘already knows.’

1. Get Medical Care Immediately

The most important thing is your health. Real danger? Call 999. Get help for concerning but non-life-threatening symptoms through the relevant NHS channel. Keep in mind that certain injuries take time to appear. Pain may appear later after a crash. The NHS advises seeking immediate medical attention for whiplash symptoms include extreme pain, tingling, weakness, or difficulty walking.

Here’s what to do:

- Check if the pain gets worse.

- Do what your doctor says.

- Write down your symptoms every day.

- Keep copies of any medical papers you get when you leave.

Here’s why this matters for a personal injury protection claim:

- It keeps you safe.

- It makes a record of your health.

2. Notify Your Insurer Promptly

The UK government’s official site outlines it very clearly. Even if you don’t plan to file a personal injury protection claim, you still need to tell your insurance company about the accident.

You also need to give information (name, address, registration number) if the accident caused damage or injury. The official website of the Government of UK says that if you didn’t give your information at the time of the accident, you need to tell the police within 24 hours.

Here’s practical script for the call:

- State the date, time, and location.

- Say if anyone was injured.

- Give information about the relevant/involved party (if you know it).

- Request a number for your claim.

- Find out what papers they want and where to send them.

- Don’t guess who is at fault on the call. Just state the facts.

3. Document Everything

Good documentation is not ‘extra.’ It is the main part of your personal injury protection claim.

Make a simple folder, either on paper or online, and keep:

i. Accident Facts

- Date and time.

- Exact location.

- Weather and road conditions.

- Where you were going.

- Speed (if you know it, don’t guess).

- What happened in what order.

ii. People and Vehicles Details

- The name, address, and registration of the other driver.

- Make and model of the car.

- Information about the insurer (if you have it).

- Names and contact information for witnesses.

iii. Photos and Evidence

- Close-up and wide shots of damage to the vehicle.

- Signs and markings on the road.

- Injuries (bruises can change quickly).

- Save a copy of the dashcam footage.

iv. Costs and Losses

- Pay stubs and notes from the doctor (if you missed work).

- Travel receipts for appointments.

- Receipts for prescriptions and treatments.

- Care notes (who helped you, and how).

Want to learn about the Personal Injury Claim Time Limit UK? When you file your claim, it’s important to know the deadlines.

4. Submit the PIP Application

The meaning of ‘the application’ changes depending on the type of claim you’re making.

Case A: Claim on Your Own Policy (Personal Accident / Personal Injury Cover)

Get the personal accident claim form or process from your insurance company. Then:

- Make sure you know who is covered (you, named drivers, and passengers).

- Check to see what kinds of injuries qualify.

- Make sure you know the deadlines for sending in documents and letting people know.

- Find out if they need a medical report or certain words.

Case B: Use Official Injury Claim (England and Wales)

Official Injury Claim (OIC) tells you who can use the service. It is for a lot of small injuries where:

- You are over 18.

- The accident happened in Wales or England.

- It happened on or after May 31, 2021.

- You were in a car.

- You think it wasn’t your fault.

- The injury value is less than £5,000.

OIC’s process starts with:

- The claim by giving details about the accident and injuries.

- Investigation by the insurer.

- Appointment and report for medical care.

- Offer and talk.

- Payment and closing.

Case C: Claim Through MIB (Uninsured Or Hit And Run)

If you don’t have insurance or were in a hit-and-run accident, The official website of the Government of UK tells you to go to the MIB. You can also file personal injury protection claims online, but you will need to sign up first, according to the MIB.

5. Cooperate With the Insurer’s Review

After you send in your personal injury protection claim, the insurers (or ‘compensator’ in OIC terms) will look it over. OIC says that after you submit your personal injury protection claim, it goes to the insurance company for the driver you say is at fault, and they look into it.

Here’s what cooperation usually looks like:

- Answering questions that come up later.

- Sending more papers.

- Going to a medical exam (if necessary).

- Confirming payment information for the bank.

Here’s what to avoid:

- Sending edited photos without keeping the originals.

- Making your story ‘sound better.’

- Not telling them when you miss a deadline.

- If you need more time, write it down.

6. Know Your Policy Limits and Exclusions

This is where a lot of personal injury protection claims go wrong. Personal accident cover is often limited by:

- Maximum payout amounts.

- Clear definitions of ‘permanent’ or ‘loss.’

- Exclusions for illegal acts, alcohol/drugs, or not wearing a seatbelt.

There are still limits on who can use the OIC route and how much it costs, such as the £5,000 injury value threshold for that service.

So always check:

- Who is insured?

- What injuries count?

- What proof is needed?

- What are the time limits?

7. Track Payments and Remaining Benefits

Use a simple tracker (notes app is fine). Or, if you use OIC, it says you can check the status of your personal injury protection claim online and get updates when they happen.

If you get money from a personal accident policy, make sure:

- If it’s one payment or a series of payments.

- If it has an effect on any other policy benefits.

- If more medical evidence is needed later.

You can read our article on What is Personal Injury Compensation Claim to learn more about what counts as a personal injury.

8. Handle Denials or Disputes

There are many reasons why someone might say no, such as:

- The injury doesn’t fit the definition in the policy.

- Evidence that is missing.

- Reporting late.

- There is an exclusion.

- There is disagreement about fault (for claims for compensation).

Your first step is easy:

- Get the decision in writing.

- Ask them what rule or clause they used.

- Ask what proof would change the choice.

If you are in OIC and there is a disagreement about who is at fault, the wider guidance says that disputes can go to court if the personal injury protection claim can’t be settled in the service. The service also helps with some parts of getting ready for court.

If you have a problem with how an insurance company is handling your claim, you can file a complaint and then, if necessary, go to the Financial Ombudsman Service (FOS). FOS says it can look into complaints about insurance and decide if the business did you wrong. If so, it might tell them to fix things.

9. Seek Legal Support If Needed

You might not need a lawyer for every personal injury protection claim. But legal help can be helpful if:

- The injury is bad.

- There is a lot of disagreement about who is to blame.

- Your losses are complicated (future care, being away from work for a long time).

- You are given a settlement that doesn’t feel right.

- There is a lot of pressure to settle quickly.

Citizens Advice also says that you should get legal advice right away if you want to take legal action because there are strict time limits. It also says that you can pursue personal injury protection claims for free (for minor road injuries that happened after May 31, 2021).

Deadlines are important. In many cases, the limit for personal injury claims based on negligence is three years. Citizens Advice says that you must file a lawsuit within three years of when you first realised you were hurt.

Case Study: Cameron v Liverpool Victoria Insurance Co Ltd

(UK Supreme Court, 2019)

In May 2013, Miss Cameron was driving when she collided with a Nissan Micra. The Micra driver did not stop. A passing driver noted the number plate. The Micra was insured with Liverpool Victoria (LV). Miss Cameron tried to claim by suing the registered keeper, but it later became clear the keeper and the LV policyholder were not the driver at the time.

Because the actual driver could not be identified, the case became about process. Could she sue an “unknown driver” just to reach the insurer? The UK Supreme Court said this type of “person unknown” defendant is not allowed when the driver cannot be identified at all (as in most hit-and-run cases). The Court explained there is a difference between an unnamed defendant who is still identifiable (like “the squatters in X building”) and a driver who cannot be identified.

Conclusion

It’s best to act quickly and stay organised when you make a personal injury protection claim. Get medical help right away. Tell your insurance company right away. Keep all of your records. Fill out forms the right way. Keep track of payments. Use facts to fight denials. Most importantly, follow your policy. PIP rules can be very strict and different from one state to the next. Get legal advice early when the stakes are high.