The Criminal Injuries Compensation Authority (CICA) serves victims of violent crime in the UK. However, it is not a guaranteed right. Victims have to prove their case-most importantly, their financial losses in crime. And the more clear proof of such losses, the greater chance of receiving appropriate reward. This blog outlines how you can demonstrate financial loss in CICA claim. It includes

- Types of loss documents you may need

- Some tips on building a stronger case

According to the Journal “Loss of Earnings Following Personal Injury: Do the Courts Adequately Compensate Injured Parties?”

“Compensation comprises an award for non-economic damage, such as pain and suffering and/or an award for economic damage, such as loss of earnings and care costs.”

– Robert McNabb et al.

Learn more about Criminal Injuries Compensation Authority (CICA).

What is a Financial Loss in CICA Claim?

In your claim, part of your amount is financial loss lost due to injury or crime. This may also include:

- Loss of earnings because of inability to work

- Cost of medical treatment

- Travelling expenses

- Other economic effects

Your criminal injury must be serious enough to have resulted in a total inability to do paid work, or partially able to do so. It means that you are not capable of undertaking more than a few hours of paid work per week. If you are able to do paid work, but the type of work is not suitable for you to work because of your injuries, you will not qualify for a loss of earnings payment.

According to a Study , out of 379 cases which in 2022/23, each claim was offered an average of £7,848. But the data showed that the CICA’s offer in these cases increased to £47,339 which is almost six times more per person.

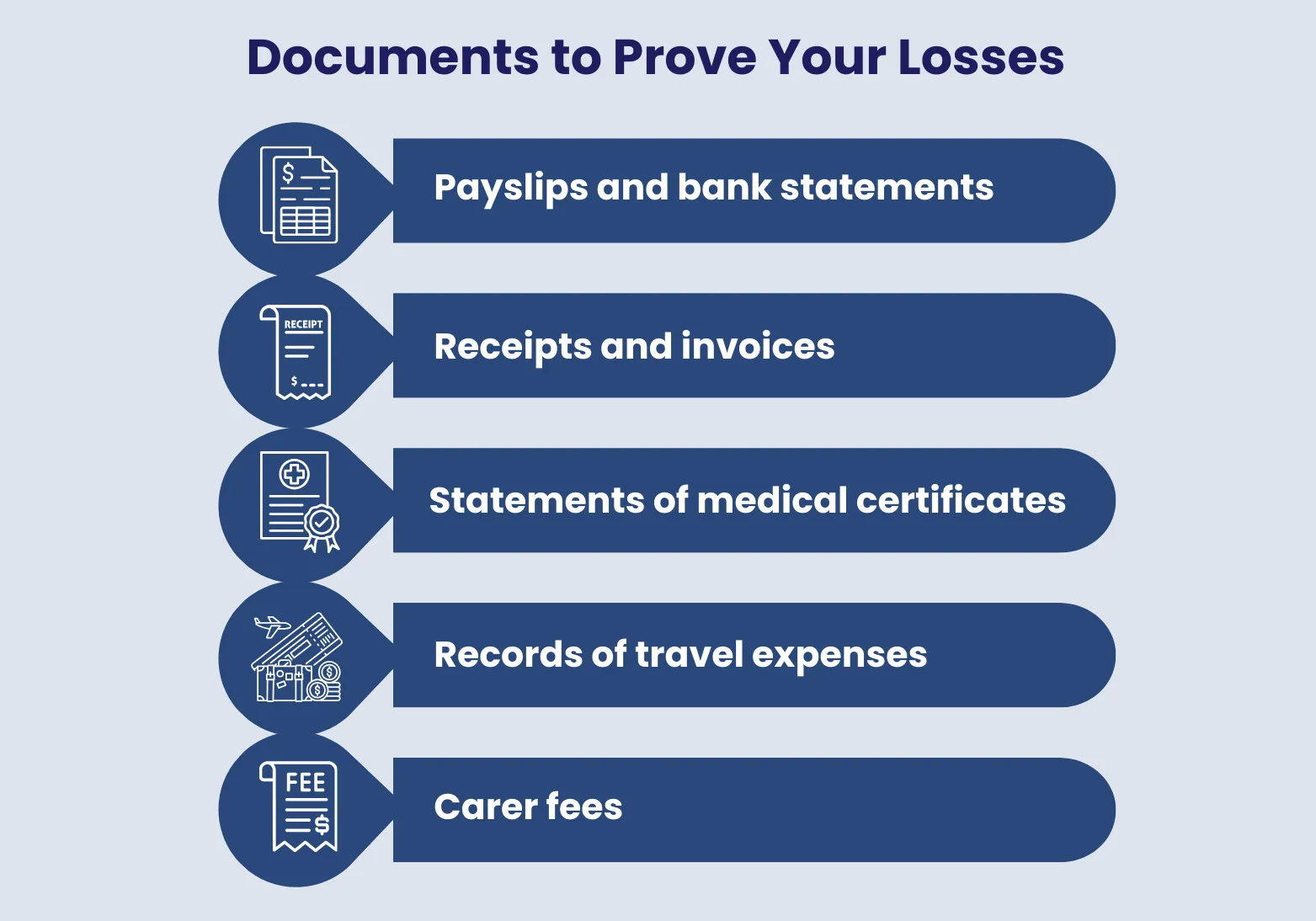

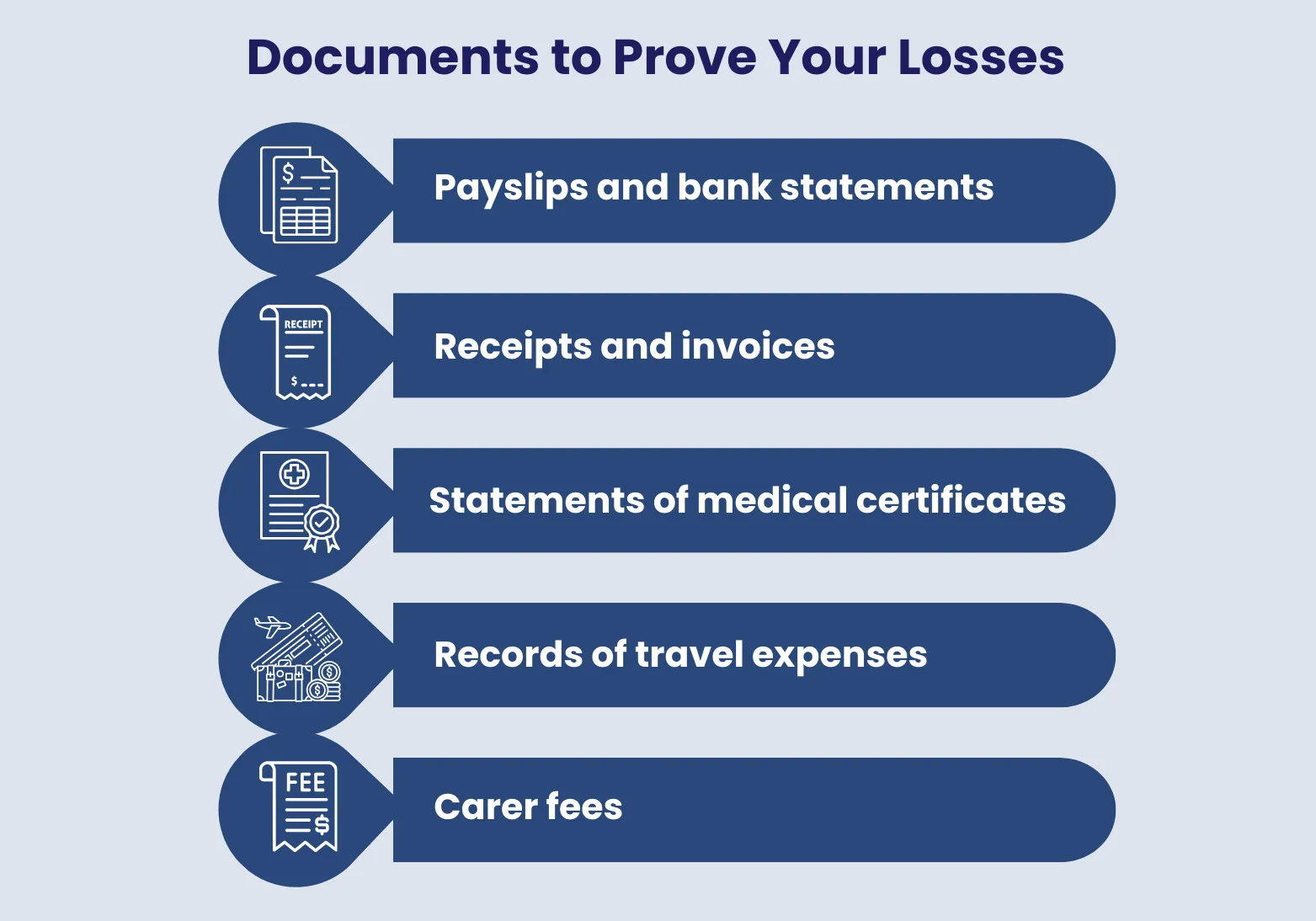

Documents to Prove Your Losses

To demonstrate financial loss in CICA claim, provide proof of your damage. It must show the specific expenses you incurred because of the crime. Evidence for financial loss in your CICA claim is a must. Otherwise, your claim could be cancelled.

The following materials should be collected as evidence:

Payslips and bank statements:

These are the two most common ways of proving lost earnings. Ideally, pre-injury and post-injury payslips are to be submitted along with supporting bank statements that reflect income reduction.

Receipts and invoices:

Any expenses for an injury-related medical treatment must be documented with receipts or invoices. This financial loss proof is used to assert claims for medical expenses.

Statements of medical certificates:

These prove that your injury has kept you away from work. It also may further indicate your treatment history. These necessary expenses are closely connected.

Records of travel expenses:

Records of travelling done to receive such medical treatments are helpful. Always document those indicating dates, distances of travel, and purposes of travel.

Carer fees:

In case you need home care, ensure you have all invoices or agreements. It helps prove the service cost. This is also a piece of CICA financial evidence that helps to support your claim.

Get an insight into How Long Does a CICA Claim Take?

Expected Financial Losses

You must know what type of losses are covered as a financial loss in CICA claim. Listed below are those categories:

Loss of Earnings:

If the results of the injury from the crime prevent you from going back to work, then you might be entitled to CICA compensation for a loss in wages.

Medical:

Expenses related to the injury, such as costs from treatments, therapies, and medication.

Travel:

Required travel because of medical appointments or rehab should also be covered.

Care Costs:

If the nature of your injuries means that you require assistance in the home, these could be recovery costs.

Property Damage:

Sometimes, it is possible to recover some personal items that may have been damaged as part of the incident.

Top 5 Tips on How to Recover From Financial Loss?

Here are some tips to recover your financial loss in CICA claim:

- Inform CICA about your intention to process a claim.

- Get medical evidence to establish your incapacity and the reasons why you cannot work.

- Get an estimation from your doctor about the duration for which you might stay unable to work. If this is long-term more detailed evidence might be needed.

- If you cannot provide salary slips etc, ask HMRC for your tax receipts for the current and prior year earnings.

Take a look at CICA Tariff Table for calculation.

How We Can Help With CICA Claim?

We at Concise Medico can get you maximum compensation for your financial loss in CICA claim. We help you with your claim by:

- Providing Advice on Eligibility

- Collecting evidence

- Filling the Application Form

- Negotiating the claim amount

- Proceeding on No-win, no-fee basis

The more structured and with greater detail your evidence is, the higher the chances of actually proving claim procedures.

Contact Concise Medico for more information on CICA claims.

FAQs

The Criminal Injuries Compensation Authority (CICA) serves victims of violent crime in the UK. However, it is not a guaranteed right. Victims have to prove their case-most importantly, their financial losses in crime. And the more clear proof of such losses, the greater chance of receiving appropriate reward. This blog outlines how you can demonstrate financial loss in CICA claim. It includes

- Types of loss documents you may need

- Some tips on building a stronger case

According to the Journal “Loss of Earnings Following Personal Injury: Do the Courts Adequately Compensate Injured Parties?”

“Compensation comprises an award for non-economic damage, such as pain and suffering and/or an award for economic damage, such as loss of earnings and care costs.”

– Robert McNabb et al.

Learn more about Criminal Injuries Compensation Authority (CICA).

What is a Financial Loss in CICA Claim?

In your claim, part of your amount is financial loss lost due to injury or crime. This may also include:

- Loss of earnings because of inability to work

- Cost of medical treatment

- Travelling expenses

- Other economic effects

Your criminal injury must be serious enough to have resulted in a total inability to do paid work, or partially able to do so. It means that you are not capable of undertaking more than a few hours of paid work per week. If you are able to do paid work, but the type of work is not suitable for you to work because of your injuries, you will not qualify for a loss of earnings payment.

According to a Study , out of 379 cases which in 2022/23, each claim was offered an average of £7,848. But the data showed that the CICA’s offer in these cases increased to £47,339 which is almost six times more per person.

Documents to Prove Your Losses

To demonstrate financial loss in CICA claim, provide proof of your damage. It must show the specific expenses you incurred because of the crime. Evidence for financial loss in your CICA claim is a must. Otherwise, your claim could be cancelled.

The following materials should be collected as evidence:

Payslips and bank statements:

These are the two most common ways of proving lost earnings. Ideally, pre-injury and post-injury payslips are to be submitted along with supporting bank statements that reflect income reduction.

Receipts and invoices:

Any expenses for an injury-related medical treatment must be documented with receipts or invoices. This financial loss proof is used to assert claims for medical expenses.

Statements of medical certificates:

These prove that your injury has kept you away from work. It also may further indicate your treatment history. These necessary expenses are closely connected.

Records of travel expenses:

Records of travelling done to receive such medical treatments are helpful. Always document those indicating dates, distances of travel, and purposes of travel.

Carer fees:

In case you need home care, ensure you have all invoices or agreements. It helps prove the service cost. This is also a piece of CICA financial evidence that helps to support your claim.

Get an insight into How Long Does a CICA Claim Take?

Expected Financial Losses

You must know what type of losses are covered as a financial loss in CICA claim. Listed below are those categories:

Loss of Earnings:

If the results of the injury from the crime prevent you from going back to work, then you might be entitled to CICA compensation for a loss in wages.

Medical:

Expenses related to the injury, such as costs from treatments, therapies, and medication.

Travel:

Required travel because of medical appointments or rehab should also be covered.

Care Costs:

If the nature of your injuries means that you require assistance in the home, these could be recovery costs.

Property Damage:

Sometimes, it is possible to recover some personal items that may have been damaged as part of the incident.

Top 5 Tips on How to Recover From Financial Loss?

Here are some tips to recover your financial loss in CICA claim:

- Inform CICA about your intention to process a claim.

- Get medical evidence to establish your incapacity and the reasons why you cannot work.

- Get an estimation from your doctor about the duration for which you might stay unable to work. If this is long-term more detailed evidence might be needed.

- If you cannot provide salary slips etc, ask HMRC for your tax receipts for the current and prior year earnings.

Take a look at CICA Tariff Table for calculation.

How We Can Help With CICA Claim?

We at Concise Medico can get you maximum compensation for your financial loss in CICA claim. We help you with your claim by:

- Providing Advice on Eligibility

- Collecting evidence

- Filling the Application Form

- Negotiating the claim amount

- Proceeding on No-win, no-fee basis

The more structured and with greater detail your evidence is, the higher the chances of actually proving claim procedures.

Contact Concise Medico for more information on CICA claims.